What is Win/Loss Analysis?

“I never lose. Either I win or I learn.”

Unknown

Why did your customer buy your product – or your competitors? This basic tactic is used by less than 20% of companies. (http://pragmaticmarketing.com/resources/the-eight-rules-of-successful-winloss -analysis).

-analysis).

Why is this? This riddle can take a seat alongside “Why do companies have such a short-term focus?” and “Why does CEO pay skyrocket even as performance declines?”

Rather than ponder the mysteries of the irrational, let us focus on something more useful – understanding this great and powerful tool, the Win/Loss Analysis.

What is Win/Loss Analysis?

It is a market research event that occurs as part of the sales cycle. As previously stated, its purpose is to determine why a deal was won or lost. In practice, it’s like any qualitative interviewing process. There’s an interviewer. A respondent, a discussion guide driven by objectives, etc.

What can we learn with Win/Loss Analysis?

We learn the perceptions that customers have regarding our entire offering. From the product itself to everything that impacts the customer experience. From purchasing, to actually using the product, to obtaining support. If customers have previous experience with our product, then those experiences would heavily weight their assessment. In addition, they will rely on many things such as:

- Experience with our sales process

- Reports from other customers – testimonials, reviews, etc.

- Case studies

- Our reputation

If we lost the sale, then our competitors bested us in their performance for certain evaluation criteria. And if we won, then we bested them. For the Win/Loss itself, our focus is on learning, understanding these criteria, and how well we performed compared to others.

Of course, we are measuring customer perceptions. If our product is superior in some way that the customer did not perceive, this “reality” did not help us. Similarly, if our business really has capabilities that the customer does not think that we have, then this “reality” likewise did not help. Though, learning this does help. At least with the next deal. We can act to fill the gap. Perhaps we need a new demonstration, a white paper, altered positioning, better advertisements, etc. to address this problem.

Think of your own experiences as a customer. Why did you choose one company/product over another? Was the sales presentation poor? Were they late? Were there technical issues with a web conference? If in person, how were they groomed? How about the proposal itself? Were there misspellings that were bothersome?

Who should we interview?

Should we focus on the lost deals or the won deals? The answer is “yes.” We need to learn from both. Each will have a bias that will infect the reliability of our insight. Those who bought from us will be positive, happy, and will reflect upon “what a wise decision it was for us to do business together!” They will be more loose-lipped about the deficiencies of the competition and will alternatively pat us on the back for having such an amazing product as well as themselves for having made such a wise decision.

Those who did not buy from us might dread the interview. A tinge of guilt. A need to placate and make us to feel better. They may craft a palatable story for our ears to digest. We must help them to get past these obstacles so that we may learn the truth. We need their help to learn about our gaps and deficiencies – no matter how painful the conversation may be.

What should be in the interview itself?

This will use the normal phases of a qualitative interview:

- Introduction

- Rapport & Reconnaissance

- Objectives

- Conclusion

During the Introduction, emphasize three points. First, an extreme appreciation for the person’s time. Second, that the goal of the interview is to learn the truth. Of why they bought or did not buy. To not worry about offending or insulting us, that it’s really nobody’s “fault” per se. The customer made the best decision that was in their interest, just as they should have.

Finally, the interviewer should emphasize that this will not be a sales call. Along those lines, we must counsel our interviewing team to never enter salesy conversations. For example, we will not overcome objections as we might normally do. In fact, we want the objections – and as many as we can get. Set a mood that is friendly, affable, and non-threatening. Throughout the interview, continue to smile, to be curious, and to encourage the customer to speak freely.

The goal of the Rapport & R econnaissance (R&R) is the same as with a typical qualitative interview – to build rapport and better understand the customer’s context. Especially when interviewing customers who did not buy from us, continue to reaffirm that “it’s ok”, that we’re not offended. Stay in the R&R phase as long as required to get the customer comforta

econnaissance (R&R) is the same as with a typical qualitative interview – to build rapport and better understand the customer’s context. Especially when interviewing customers who did not buy from us, continue to reaffirm that “it’s ok”, that we’re not offended. Stay in the R&R phase as long as required to get the customer comforta

ble, chatty, and in a mood to be truthful. Five to ten minutes is plenty.

The Objectives section is the heart of the interview. The “heart” because this is when most of the learning will occur. Create a discussion guide to keep the conversation on point. As you ask each question, keep in mind that it’s not just the “answer” that you’re looking for. Go beyond. Listen intently. Probe for clarification. Seek to understand. When you feel that you understand a point well enough, use the “What else?” question. This gives the customer permission to provide a different answer or elaborate on a previous response. Another good follow-up probe that you can use at almost any time is, “Can you tell me a little more about that?” Here are some question lead-is to consider for your discussing guide:

- What were you seeking to accomplish with this product?

- What alternatives did you consider?

- What would the ideal product (or features, attributes, etc.) be? (As a follow-up to this: what would that feature/attribute help you to accomplish?)

- What criteria were you using to evaluate this purchase?

From those questions and similar, you can develop criteria. Prior to wrapping up Objectives, it’s a good idea to quantify the customer’s thoughts using benchmarking questions.

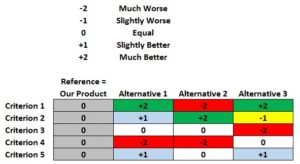

Benchmarking within the Interview

This is a simple exercise that will help you to understand your relativestrength to competitors. Ask your customers, “with our product as the reference, how would you score the following alternatives? Is this about this same as ours, a little better, much better, a little worse, or a lot worse?”

The product is a logical place to begin – but don’t stop there. Ask about your reputation. About the sales process. Support – anything. Use the items that came up in the earlier part of the discussion.

Continue to probe for “why?” Why each is one better, worse, etc. Don’t hesitate to make sure that you understand the reasons fully enough.

When it’s time to move to the Conclusion phase, when your time is at an end and you have learned all that you are going to – you only need a couple easy questions to leave on good terms. With your data obtained, you transition into a relationship-building mode. Here are three questions – any of which can serve this purpose:

- Out of everything that we’ve discussed, what should we focus on to improve?

- What do we need to do differently to earn your business?

- If the president of our company was here right now, what advice would you give them?

These questions signal that the interview is ending while leaving the door open for more commentary.

Who should conduct the interviews?

If the sales person conducts the interview, it provides an opportunity to build the relationship even from the wreckage of lost business. A conversation between peers without the stress of sales negotiation, a nice segue for future goodwill. But truthfully, most sales people struggle to refrain from selling – it’s too natural for them to slip into that comfortable habit. Also, since the sales person contributed to the experience, the customer may be reluctant to share anything that the sales person did poorly. The result? Our data will likely seem to support the case that the business was lost due to everything other than the sales person: product, competition, delivery time, price, etc. Of course, when the sales person is our moderator and notetaker, they are likewise unlikely to record anything negative about their own performance.

Consider what you might do instead. You could have someone who wasn’t involved with that project as moderator. Perhaps product managers could take turns conducting interviews for each other’s products.

The best practice is probably to outsource the Win/Loss interviews. When speaking with a third party, the customer is more likely to provide an honest response. There is no doubt that this will provide the highest quality, least biased data.

When should the interviews be conducted?

The interviews should be conducted within three months of the deal, whether won or lost. The purpose of the interview is to learn, and we cannot get data from customers who cannot remember it.

What do we do with the data?

As soon as we have finished all our interviews, we are ready to study the cumulative findings. Store, code, and compile the data for analysis.

findings. Store, code, and compile the data for analysis.

Use Excel to create tables and charts to present the insights graphically. Be bold! With the conclusions in hand, it is not the time to worry about hurting people’s feelings. Everyone should embrace the process as an opportunity to improve for the good of the entire business. Make sure that any specific findings are routed to those who need it most. Product deficiencies to the product managers, presentation issues to the sales managers, positioning misfits to the marketing managers, and so forth.

For more information on Win/Loss Analysis, consult the following sources:

- From a Good Sales Call to a Great Sales Call: Richard M. Schroder (2010).

- Webinar: The Eight Rules of Successful Win/Loss Analysis: Roger W. Allison (http://pragmaticmarketing.com/resources/the-eight-rules-of-successful-winloss-analysis-webinar)